LTCi Sales Ideas

Using Inflation Protection to Reach a Desired Premium

The Need

The cost of everything from gas to groceries is certain to be higher down the road. The same is true for long-term care services. That’s an important reason to recommend your clients purchase a long-term care policy and that they include an inflation protection rider for an added measure of security.

Today’s Reality

At today’s prices, most people simply can’t afford to pay for long-term care services out of their own pockets. With the national average cost of a home health aide approaching

$60,000 per year, a one-bedroom unit in an assisted living facility costing over $52,000 and a private room in a nursing home at almost $100,000, it’s easy to see the value an LTCi policy provides. But fitting a premium payment into an already tight budget still can be challenging.

The Solution

With the variety of inflation protection options available on a MutualCare® Custom Solution policy, you can easily tailor a plan of coverage to arrive at an acceptable premium amount. Adjusting the inflation duration and inflation percentage gives you the ability to meet the needs and budget requirements of any client.

Three Inflation Protection Strategies

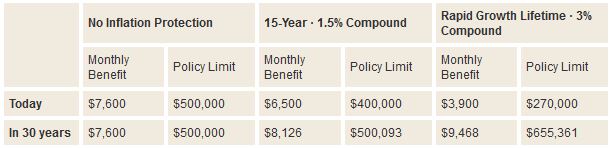

Let’s assume you have a client who can afford to spend $200 per month for long-term care insurance. Here are three different inflation protection strategies you could use to reach the desired premium:

Learn more! Go to mutualofomaha.com/sales-professionals, long-term care page for details about Mutual of Omaha’s LTCi products.

Using Inflation Protection to Reach Desired Premium

#goldencareagent

#mutualofomaha

#longtermcare