Why look at Thrivent when prescreening your client’s health?

- Few carriers publish preferred rate class guidelines. Thrivent considers all applicants for a preferred rate, and the underwriting guide outlines the preferred health criteria.

- Thrivent doesn’t auto-decline based on someone being declined by another carrier. (If declined elsewhere though, prescreening health with an underwriter is a must)

Read on for Preferred health guidelines and build chart.

Preferred Underwriting Checklist

Page 5 of the Underwriting Guide

All applications are considered for preferred issue, but the criteria below can help determine whether your client may qualify for the preferred risk class. We recommend quoting standard rates for most applicants.

- No tobacco product(s) used within the last two years.

- Physical exam within the past 24 months.

- Build within body mass index (BMI) 18 to 30.

- All questions answered “no” appropriately on the preliminary Declaration of Insurability.

- Average blood pressure levels 135/85 or below with no medication adjustments to improve control in the past six months.

- No disease or disorder of the heart, blood, or circulatory or immune system other than controlled hypertension; cholesterol is under good control, stable and not requiring medication adjustments to improve control.

- No history of cancer in the past 10 years (excludes non-melanocytic skin cancers).

- No history of chronic respiratory disease (excludes asthma not requiring daily treatment).

- No history of epilepsy, seizures, tremor (excluding benign essential tremor) or other neurological condition.

- No oral steroid or regular narcotic use in the past six months.

- No disease or disorder of the nervous system including psychiatric care (excludes mild anxiety and mild depression on no more than one medication with any antipsychotics).

- No history of hip replacement, osteoporosis, rheumatoid or psoriatic arthritis.

- No history of osteoarthritis requiring regular daily medication (other than OTC).

- No history of disabling spine or back condition.

- No history of diabetes mellitus.

- No history of ulcerative colitis or Crohn’s disease.

- No history of falls within the past 12 months or multiple falls within the past 24 months.

- No history of home health care, adult day care, assisted living facility, nursing home or other custodial facility care.

- No condition causing crippling or limited motion or requiring adaptive devices.

- No current use of any aid or appliance for mobility.

- Has not been declined or rated for long-term care insurance in the past three years.

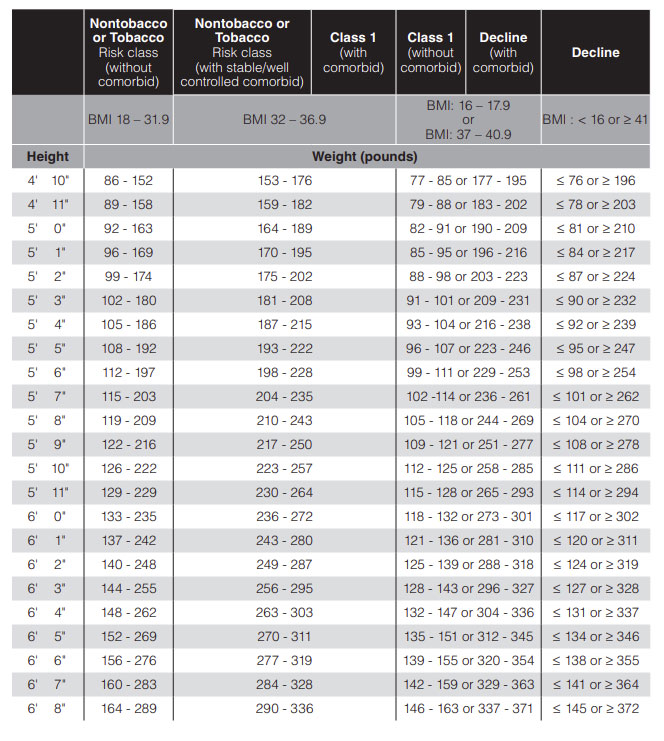

Build Chart

Plage 12 of the Underwriting Guide

Prescreening Contact

For optimal client experience, we recommend you prescreen your client’s health before applying. Prequalification can be done using our joint prescreening form for either Thrivent LTCi solution.

#goldencareagent

#thrivent

#ltc