Washington State LTC Update

As a leading long-term care insurance carrier, Thrivent has a responsibility to our contract holders and distribution partners to ensure that product offerings are being used in a manner consistent with their original intent around protecting clients against the risk of long-term care.

The Washington State Cares Fund announcement is prompting us to implement changes to ensure that sales of Thrivent LTC are the result of financial advice based on the client’s unique needs, rather than as an available (and temporary) option to avoid a payroll tax.

Thrivent will implement the following changes to our long-term care insurance product for sale in the state of Washington effective at 10 AM Pacific/ 12 PM Central on Friday, May 28th:

- We will increase our minimum issue age to 40.

- We will increase our minimum monthly benefit amount to $3,000.

- Paper or electronic applications for proposed insureds under age 40 or monthly benefit less than $3,000 (eApp or Paper) must be received at Thrivent by 10 AM Pacific/ 12 PM Central on Friday, May 28th.

- There will be no exceptions made to these deadlines.

Illustration changes

Given these changes, beginning Friday PM, system edits will be implemented on Thrivent LTC illustrations if an attempted illustration does not comply.

- Thrivent Comprehensive illustrations (partner.thrivent.com) will include on-screen messaging indicating why the illustration cannot be completed.

- iPipeline illustrations will return a generic error message that states “Illustration Web Service Error: Ledger Could Not Be Generated.” When OK is clicked for the error, the user will be returned to the illustration screen.

These changes are only being made for the state of Washington.

Best practices to ensure client’s desired issue date

Following are application process guidelines for any Thrivent long-term care insurance contract where the applicant wants the application date to be the issue date:

- The premium must be submitted with the application.

- The advisor must include a note on the Representative’s Information form 27155/e-app screen requesting the issue date be the application date.

- Thrivent will not switch back and forth, or re-issue contracts to accommodate changes to the issue date.

- Thrivent will not hold applications to be issued on a specific date.

Commission Chargeback Schedule

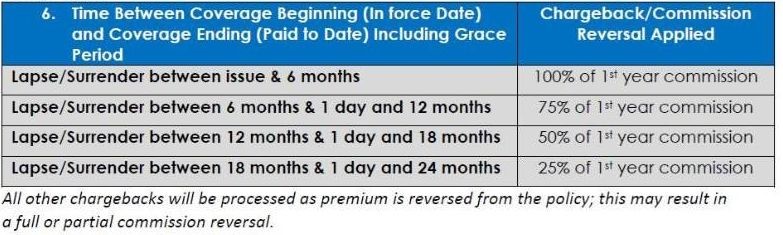

A LTC contract should be used as a tool to support clients’ LTC planning needs. There is concern that clients may not intend to keep their contracts after getting their exemption to the payroll tax. As a reminder, commission chargeback rules will apply in the event the client does choose to lapse the policy shortly after it’s issued.

Following is Thrivent’s commission chargeback schedule:

With appreciation for your partnership.

Steve Sperka

Vice President – Health Insurance Products

Thrivent

Thrivent LTC: Washington State LTC Update

#goldencareagent

#thrivent

#ltc