At Mutual of Omaha, we exist for our customers. That’s why we want you to know that we’re closely monitoring the global coronavirus (COVID-19) outbreak and taking precautionary measures to promote the health and safety of our customers and associates.

Although our physical location is closed, we have implemented measures so that business remains as usual for customers. Our associates are working remotely taking calls and processing customer requests.

This article includes information regarding:

- Extending grace periods

- Processing of policy claims during an extended grace period

- Life insurance policy coverage during a pandemic

- Changes to duplicate policy request processing

- Self-service resources available to you and your customers

Extending Grace Periods

Mutual of Omaha is committed to helping our customers as much as we can during these challenging times. We are following regulatory guidance on a state-by-state basis regarding extending grace periods and/or non-cancellation/non-renewal requirements. Please refer to your state’s Department of Insurance website for the most current information on measures in your state.

For life insurance and Med Supp policies, if your customer is not able to make a premium payment and is in a state that has not provided regulatory guidance, please reach out to us. While we are unable to waive premiums, we can typically extend the grace period on a customer’s policy for up to an additional 30 days. It is important to communicate to your customer that once the extended grace period has been reached, the customer will need to pay his/her premiums in full to prevent coverage from lapsing. If your customer has additional concerns as the extended premium due date approaches, please do not hesitate to reach out to us.

For individual health policies (other than Med Supp), if your customer is not able to make a premium payment and is in a state that has not provided regulatory guidance, please reach out to us and we will work with underwriting to determine if the grace period can be extended.

Processing of Policy Claims

If a policyholder is within an extended grace period on his/her policy, the claim will be processed according to the provisions in the contract.

Special Information for Medicare Supplement Policies

It is important to note that claims received in the extended grace period will auto-deny during the automated claims adjudication process. Policyholders will receive an EOB to indicate the claim is not paid.

Once the policyholder pays premium and their policy is paid to current, the claims will be reprocessed. The policyholder will receive an EOB to describe the adjustment of the claim.

If you have any questions regarding this, please contact Customer Service.

Special Information for Life Insurance Policies

If an insured dies within the extended grace period, benefits will be payable according to contract provisions. There is no exclusion in any of our life insurance policies that would apply to death caused by COVID-19, or any other disease. It is important to note, however, that benefits are payable under an Accidental Death policy only for deaths caused by accidental injuries as defined in the policy.

Changes to Duplicate Policy Request Processing

Duplicate policy requests require manual assembly, which we are unable to do at this time. If you or your customer are requesting a duplicate policy, we can only provide the policy via email.

We can share many details of the customer’s policy over the phone. If there is any information that can be obtained without requesting a full duplicate policy, please contact our Customer Service department and we would be happy to provide this information.

Self-Service Resources Available to You and Your Customers

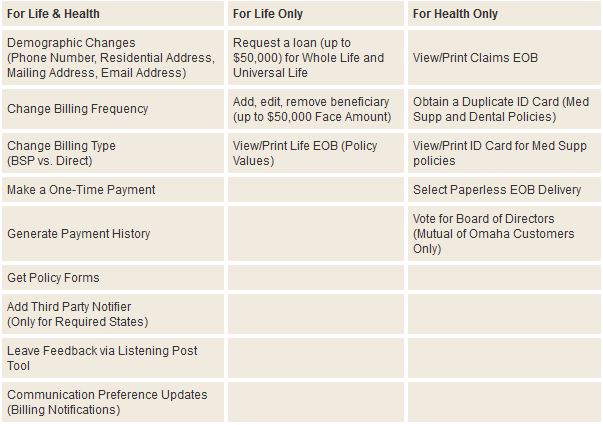

Our wait times across all product lines remain low. To continue to maximize the availability of service associates who can answer customer calls, we encourage you and your customers to use the self-service resources that are available, such as Customer Access. Customer Access provides several self-service capabilities*, such as:

* Self-service capabilities listed here may not be available for all policies.

Accessing Customer Access

Your customers can register or sign-in to Customer Access 24/7 by going to http://www.mutualofomaha.com/access.

As a producer, you can access much of this same information in Sales Professional Access (SPA) by following these instructions:

- Search in SPA on the Policy Information page by client’s policy number, first initial and last name – or by the last 4 digits of their social security number

- Click on the “Customer Access” link next to the client’s name

- This will open Customer Access in a new window

If you or your clients have any questions, please contact Customer Service at 800-775-6000 and be sure to identify yourself as a “producer” when prompted. Representatives are available Monday-Thursday, 7 a.m. to 5:30 p.m. and Friday, 7 a.m. to 5 p.m. CST.

Important Updates from Customer Service

#goldencareagent

#mutualofomaha